Will Social Security Really Run Out by 2035? Here’s What You Need to Know

You might have seen alarming headlines claiming that "Social Security will be bankrupt by 2035." But the reality is far more complex—and less dire. In this article, we’ll take a closer look at what the future holds for Social Security, especially for those who won’t start claiming benefits until after 2035. But first, let’s take a step back and explore how Social Security came to be.

A Brief History of Social Security

Social Security was one of the cornerstone programs of President Franklin D. Roosevelt’s New Deal in the 1930s, designed to pull America out of the Great Depression. It had two main goals: to reduce poverty among senior citizens and to encourage older workers to retire, making room for younger workers and lowering unemployment. Today, Social Security is a crucial lifeline. According to the Center on Budget and Policy Priorities, in 2024, about 10.2% of seniors are below the poverty line—but without Social Security, that figure would skyrocket to 38.7%. As much as we might grumble about the deductions from our paychecks, Social Security is undeniably a pillar of the U.S. economy. So, what happens if the program’s reserves run dry?

The Future of Social Security: Fact vs. Fiction

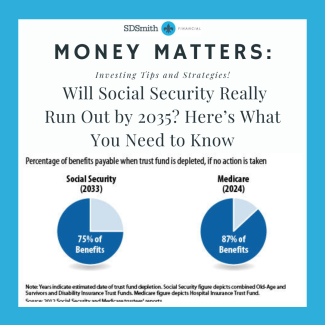

Let’s get one thing straight: Social Security isn’t going away. As I often tell people, eliminating Social Security would be political suicide—especially since older Americans, who are the primary beneficiaries, are also some of the most reliable voters. Even if the reserves are depleted, benefits will continue, funded by the contributions of current workers. Right now, those contributions cover about 83% of benefits paid. So, if nothing changes, we could see benefits reduced to about 83% of what they are today.

It’s also important to remember that Social Security is only one piece of the retirement puzzle. Currently, it’s designed to replace about 35% of your pre-retirement income. If the program’s finances aren’t shored up, that figure could drop to around 29%. So, what are the potential fixes?

How to Fix Social Security: Three Possible Solutions

-

Raising the Income Cap

Right now, there’s a cap on how much income is subject to Social Security taxes, set at $168,600. One potential solution is to raise this cap, which would mainly affect higher-income workers—about 8% of the population. For example, raising the cap to $300,000 could generate an additional $300 billion in revenue for Social Security. -

Increasing the Retirement Age

When Social Security was established in 1935, the full retirement age was 65, while life expectancy was just 62. Today, full retirement age is 67, and life expectancy is 76. Raising the retirement age could help reduce the deficit, but it’s not a cure-all. People are living longer and drawing benefits for more years, so this measure would only partially address the issue. -

Reforming Social Security Taxation

Currently, up to 85% of Social Security benefits are taxable if your income exceeds certain thresholds. For instance, if you receive $35,000 in Social Security benefits and withdraw $50,000 from a traditional IRA, a significant portion of your Social Security could be taxed. I believe that these tax dollars should be redirected back into the Social Security fund rather than going to the IRS. While the calculations would be complex, this change could help reduce the program’s deficit.

These are just a few of the ideas being floated to secure Social Security’s future. While it’s not a hot topic in this year’s election, expect it to be front and center by 2028. If no action is taken by 2032, it will undoubtedly be a top issue. Hopefully, this article has reassured you that Social Security will likely be there for your retirement—but remember, it’s only one part of a comprehensive retirement plan. To ensure the rest of your plan is in place, feel free to set up a call with me to discuss your options.