Don't Fall for These Life Insurance Sales Tactics: What You Really Need to Know

You’ve seen the commercials—a husband and wife talking about a friend who died without life insurance. These ads are designed to scare you, and for good reason. Life insurance is a crucial part of family financial planning. However, it’s also a 3 trillion-dollar industry riddled with sales tactics and exploitation.

While term life insurance is straightforward, two types of policies—Whole Life Insurance and Index Universal Life Insurance (IUL)—often come with aggressive sales pitches. Let’s break down these policies and the tactics used to sell them, so you can make informed decisions.

Whole Life vs. Index Universal Life Insurance

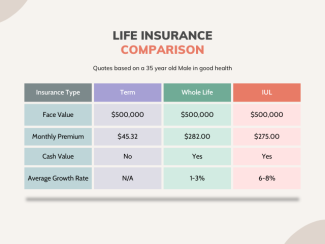

Both Whole Life and IUL policies have a face value, a premium, and a cash value, but they differ in keyways:

- Whole Life Insurance: Has a fixed premium and the cash value is invested conservatively, similar to a money market account, yielding around 1-3%.

- Index Universal Life Insurance (IUL): Features a variable premium and invests cash value in an equity index with a cap (usually 8-12%) and a floor (0%).

Why Are These Policies Over-Sold?

Unlike selling securities, selling life insurance doesn’t require a securities license. This makes it easier for salespeople to push these policies. Term insurance is also easy to sell, but it’s less lucrative for salespeople who can earn three times the commission by selling Whole Life or IUL policies.

Common Sales Tactics to Watch Out For

- "Rich People Do This":

- The Pitch: Wealthy individuals use life insurance to protect their assets.

- The Reality: Rich people use life insurance to preserve their wealth, not to accumulate it. If you aim to build wealth, consistent investing is more effective. Dave Ramsey’s study found that 80% of millionaires invested in their company's 401(k) plan, and 75% attributed their success to regular investing.

- "It’s a Hedge Against Your Investments":

- The Pitch: If the market crashes, your life insurance cash value remains intact.

- The Reality: This fear-based tactic ignores the long-term view most investors take. While a market dip might hurt short-term, staying invested usually yields better returns. For instance, the market rebounded by 18% in 2020, whereas an IUL would have capped gains at 8-12%.

- "Your Family Needs It":

- The Pitch: Emphasizes the importance of life insurance for family security.

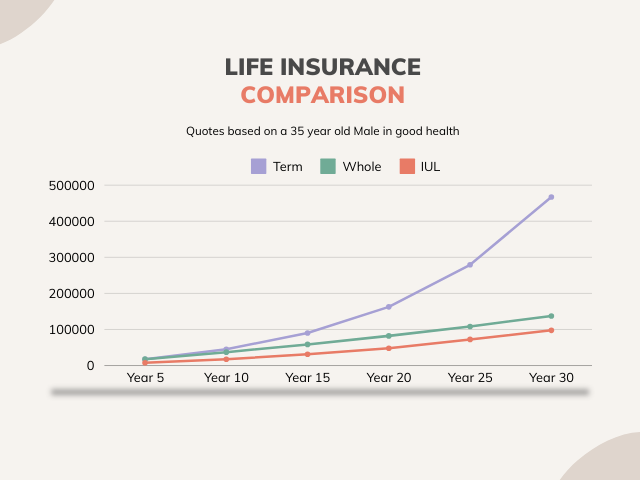

- The Reality: Having life insurance is smart, but term insurance is often a better choice. It’s cheaper and frees up more money for higher-return investments. Term policies don’t have a cash value but offer substantial coverage at a lower cost. Our graph here shows what investing the difference can look like in the long run:

Conclusion

Life insurance is essential for family financial stability, but many "financial professionals" prioritize their commissions over your best interests. By recognizing these sales tactics, you can avoid overpaying for policies that don't suit your needs.

If you have a life insurance policy and want a fiduciary advisor to review it, schedule a consultation [https://calendly.com/korey-knepper/consultation]. Thanks for reading and stay savvy!