Saving for Your Kids’ College? Where to Start?

College education is as expensive as it has ever been. Many people in their 30s and 40s are still struggling to pay down their student loans. This event has left a lasting impact on the Millennial generation, and a lot of Millennials are wanting to make sure their kids do not go through the same problems. How to save for college, and knowing how much to save can be tricky, but we can walk you through the steps!

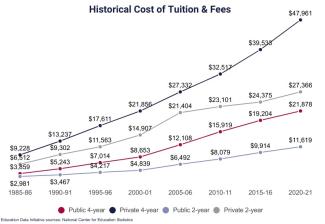

How much you should save for college is up for debate. How much will college cost in 10 years, or 15 years? The tuition inflation has slowed down and has been below 5% since 2012 according to the U.S. Inflation Calculator1. It seems as if the expansion of online capabilities has slowed down the constant rise of tuition costs, which helps. On average, 4 years of tuition at an in state public university will cost around $104,108 according to educationdata.org2. Some of this tuition cost can be paid by scholarships, grants, and financial aid, but a sizable part of it will be either out of pocket, or via student loans. So, what is the first step to saving for college?

The biggest piece are the account types, the most well-known being the 529 Plan. A 529 Plan acts similarly to a Roth IRA (more on that later), where the money you contribute has already been taxed, and can be taken out tax free. The old issue was, if you did not use the 529 Plan for education expenses, then the money would be withdrawn with a penalty. However, thanks to the Secure Act 2.0, that is no longer the case. You can now use that 529 Plan to start funding a Roth IRA for the beneficiary if the account has been open for at least 14 years. With this new change, we are almost exclusively recommending the 529 Plan for college education saving plans. A couple of other notes on the 529 Plan, you can change the beneficiary if needed, and anyone can contribute, not just the owner.

There are other ways out there that can also work, those are an UTMA/UGMA, a Universal Life Policy, or a normal brokerage account. All of these come with some benefits, and some shortcomings. The Universal Life policy has the advantage of having a death benefit, and a cash value that could be used for anything, not just education. However, the investment growth and freedom are going to hurt the total interest on the account. An UTMA (Uniform Transfer to Minors Act) allows you to manage an account that is owned by your child. When they come to the age of maturity (25 years old) they now manage the account. The growth on the account is taxed to the child, however, the first $1,100 is tax free. The big advantage over a 529 Plan is this money does not have to go towards education, however, it can also influence FASFA. An UGMA (Uniform Gift to Minors Act) is the same as an UTMA, however, the age of maturity is different (18-21 depending on what state you are in).

The normal brokerage account is another way to save for college. This money stays in your name, you invest it, and you pay the taxes on it. For those who do not know how a brokerage account works, here is a quick explanation: Your contributions are post-tax like a Roth IRA, however, any gains in the account will be taxed. The tax amount will be decided by how much, and how long you have held the investment. We use brokerage accounts for all sorts of things, and college education planning is one of them. However, the way we use it might be different than most. If you are like most financially cautious Americans, you have saved up an emergency fund. Let us say this emergency fund has $50,000 in it. I would suggest putting $40,000 into a brokerage account, and investing in a high yield fund, which is currently paying around 7% with current interest rates. That can create $2800 of income in 2024, which you then use to contribute to the 529 Plan. This allows your emergency savings, which you still have full access to in case of that emergency, to help fund your child’s education plan. At SDSmith Financial we do not charge for 529 Plans, and if you are interested in learning more, you can book a call here!

Thanks for reading!

College inflation: Prices for tuition and fees (1978-2023). US Inflation Calculator | Easily calculate how the buying power of the U.S. dollar has changed from 1913 to 2023. Get inflation rates and U.S. inflation news. (2024, January 11). https://www.usinflationcalculator.com/inflation/college-tuition-inflation-in-the-united-states/

Hanson, M., & Checked, F. (2023, November 18). Average cost of college [2023]: Yearly tuition + expenses. Education Data Initiative. https://educationdata.org/average-cost-of-college